Best Veteran Debt Assistance Programs of 2026

If you’re a veteran dealing with debt, you aren’t alone. This is a battle that hundreds of thousands of other veterans just like you deal with every day.

The good news is that there are proven programs across government agencies, military relief societies, nonprofits, and trusted private services that help veterans regain stability. This guide compares the best veteran debt assistance programs in 2026 so you can see what’s legitimate, what works, and how each option fits different situations.

Before comparing, it helps to understand how we evaluated each program:

- Effectiveness: How often the program actually delivers relief.

- Cost: Fees charged to veterans (lower is better).

- Eligibility: How attainable the requirements are.

- Veteran Features: Benefits tailored to service members, vets, and families.

⚠️ Note: Availability can change based on funding, branch, and personal circumstances. Always verify before applying.

The Best Veteran Debt Assistance Programs of 2026

These are the best veteran debt assistance programs in 2026, covering every major option available to service members, veterans, and families. Some help prevent new debt, others reduce or restructure what you already owe. The chart below breaks down what each program does, what it costs, who qualifies, and how long it typically takes to see results. Use it as a quick guide before choosing the path that fits your situation best.

|

Program Type |

What it Does |

Cost to You |

Eligibility |

Typical Timeframe (Application → Debt Relief) |

Best For |

|---|---|---|---|---|---|

|

VA Debt Management Center |

Resolves most VA-related debts through repayment or waiver. |

$0 |

VA-related debt only |

2–8 weeks |

VA overpayments, copays |

|

SCRA Protections |

Strong protection for active-duty members’ pre-service debts. |

$0 |

Active duty + pre-service debt |

Immediate |

Active duty with pre-service debt |

|

HUD Housing Counseling |

Prevents foreclosure via lender negotiation and guidance. |

$0 |

Homeowners in distress |

2–6 weeks |

Mortgage issues |

|

Student Loan Relief (Federal programs) |

Reduces or forgives federal student loan balances through income-driven repayment, forgiveness programs like PSLF, or discharge options for disability or hardship. |

Usually $0 (for program participation) |

Veterans with federal student loans who meet income/eligibility rules |

Months–years |

Student loan repayment & forgiveness |

|

Army Emergency Relief (AER) |

Quick emergency loans or grants for essentials. |

$0 |

Army personnel & families |

1–7 days |

Emergency expenses |

|

Navy-Marine Corps Relief Society (NMCRS) |

Rapid, reliable aid for short-term financial crises. |

$0 |

Navy/Marines & families |

1–7 days |

Emergency expenses |

|

Air Force Aid Society (AFAS) |

Effective same-day help for urgent expenses. |

$0 |

Air Force & Space Force |

1–7 days |

Emergency expenses |

|

NFCC Credit Counseling |

Lowers rates, consolidates payments, improves repayment odds. |

$0–$50/mo |

Stable income preferred |

30–60 days to enroll; 3–5 years repayment |

Debt management plans |

|

Operation Homefront |

Temporary relief for housing, utilities, or food. |

$0 |

Military families in hardship |

1–3 weeks |

Temporary relief |

|

Accredited Debt Settlement Firms |

Negotiates 40–60% reductions on unsecured debt. |

20–25% of enrolled debt |

$7,500+ unsecured debt |

6–48 months |

Large unsecured debt |

|

VA Cash-Out Refinance |

Converts home equity to pay off high-interest debt. |

Closing costs only |

VA loan eligibility |

30–45 days |

Homeowners with equity |

Government Programs

Government-backed programs are where most veterans should start. They’re official, free, and built to help veterans dig out from under debt the right way. If your bills trace back to the VA, federal loans, or your service, start here before looking elsewhere.

VA Debt Management Center (DMC)

If you’ve received a notice about overpayments, medical copays, or other VA-related debts, the Debt Management Center is your direct line for resolution.

You can request a repayment plan, apply for a hardship waiver to cancel the debt, or make a compromise offer to settle it for less. Most cases are resolved once veterans submit complete documentation and financial details. The process takes about 2–8 weeks and is always free.

If you get a notice about overpayments, copays, or other VA debts, don’t panic. The Debt Management Center is where you handle it. You can set up a payment plan, ask for a waiver, or make a compromise offer.

Apply online through the VA Debt Portal or call 1-800-827-0648. Most cases wrap up within a few weeks once your paperwork is complete.

SCRA Protections

SCRA protections are federal law. Lenders must cap your pre-service debt interest at 6% if you're on active duty and stop foreclosures or default judgments without a court order. You’ll need to send a written notice and a copy of your orders to activate it, but once applied, the relief is immediate.

If you’re on active duty, the SCRA caps your pre-service debt interest at 6% and stops foreclosures or default judgments. Send your lender a written request with your active-duty orders. Once they receive it, the protection takes effect immediately.

HUD Housing Counseling

If you’re behind on your mortgage or worried about foreclosure, a HUD-approved counselor can help. They’ll contact your lender, walk through modification or forbearance options, and ensure your servicer isn’t railroading you.

These counselors don’t charge you a dime, and many specialize in VA loan workouts, which saves time and frustration.

If you’re falling behind on your mortgage, a HUD-approved counselor can talk to your lender and help you find fair options like modification or forbearance. Call 1-800-569-4287 or visit hud.gov/housingcounseling to connect with someone experienced in VA loans.

Student Loan Relief

If you’ve got federal student loans, you’ve got tools. Income-driven repayment plans can lower your monthly bill, and Public Service Loan Forgiveness can erase the rest if you qualify. There’s also consolidation for vets juggling multiple loans.

The process can take time (sometimes years), but it’s often the difference between debt burden and long-term stability.

If federal student loans are weighing you down, programs like income-driven repayment or PSLF can reduce or forgive what you owe. Apply or update your plan at studentaid.gov using your income and loan details. The process takes time, but the long-term relief is worth it.

Military Relief Societies

Emergencies hit everyone, and when things like a blown transmission, an overdue utility bill, or a last-minute flight home arise, these programs have your back. They won’t erase old debt, but they’ll stop new debt from piling up. Every branch has one, and every one of them is worth knowing.

Apply through your base office or online:

- Army Emergency Relief (AER): armyemergencyrelief.org

- Navy-Marine Corps Relief Society (NMCRS): nmcrs.org

- Air Force Aid Society (AFAS): afas.org

Most veterans receive approval within a few days.

Army Emergency Relief (AER)

AER provides interest-free loans and grants for emergencies. You can walk in, explain your situation, and get an answer within days (sometimes hours).

There’s no credit check, and repayment terms are fair.

Navy-Marine Corps Relief Society (NMCRS)

NMCRS offers grants and 0% loans for short-term crises, such as housing, utilities, medical bills, and travel. It also provides budget counseling, which can help prevent repeat emergencies.

Air Force Aid Society (AFAS)

AFAS steps in fast when Airmen or Guardians hit financial trouble. They cover urgent costs and offer education support for dependents. Processing is quick, especially if you’re near a base office.

Nonprofits

These nonprofit programs are where you can get structure, accountability, and fundamental tools to manage or reduce debt. They focus on immediate relief, steady progress, and lasting financial stability.

NFCC Credit Counseling/Debt Management Plan (DMP)

If high-interest credit cards are eating your budget alive, this is where you go. Certified counselors at NFCC agencies can negotiate lower interest rates and combine your payments into one manageable monthly plan.

You’ll still pay your debt, but under better terms and with someone in your corner guiding the process.

If high-interest credit cards are draining your budget, NFCC counselors can lower your rates and combine payments into one manageable plan. Apply at nfcc.org or call 1-800-388-2227. You’ll review your budget first, then set a clear repayment plan.

Operation Homefront

Operation Homefront offers emergency grants for basic living expenses. It’s not guaranteed (funding depends on location and need), but when it’s available, they move fast.

This kind of help keeps families afloat without racking up more credit card debt.

When you need fast help with essentials, Operation Homefront can provide emergency grants. Apply at operationhomefront.org with proof of service and hardship. They respond quickly when funds are available.

Legal Aid & Veteran Service Organizations (VSOs)

When debt ties back to VA benefits, disability compensation, or collection disputes, legal aid and VSOs can help. They offer free or low-cost representation to challenge bad claims, stop harassment, and appeal improper overpayment decisions.

Most are run by veterans or attorneys who know the system and won’t let you get pushed around.

If your debt connects to VA benefits or a bad claim, don’t face it alone. Legal aid and VSOs can help you appeal, stop harassment, and protect your rights. Reach out through statesidelegal.org or contact DAV, VFW, or the American Legion.

Private Services

If you’ve exhausted your free or nonprofit options and still can’t make headway, these can help. However, it’s critical to be aware of the potential cost and risk. Know precisely what you’re signing before you move forward.

Accredited Debt Settlement Firms

If you’re drowning in unsecured debt (credit cards, medical bills, or personal loans), settlement firms can negotiate partial payoffs with creditors.

Most veterans see 40–60% reductions, but the process can hurt your credit and take time.

Only work with firms that are state-licensed and don’t charge upfront fees.

If you’re deep in unsecured debt, settlement firms can negotiate lower balances. Only work with AFCC-accredited, state-licensed firms and avoid anyone charging upfront fees. Always read the fine print before agreeing.

VA Cash-Out Refinance

If you own your home and have built up equity, a VA-backed cash-out refinance lets you use that equity to pay down higher-interest debt.

It can free up monthly cash flow, but it also restarts your mortgage. So, you need to do the math before signing.

If you have home equity, a VA cash-out refinance can free up money to pay down higher-interest debt. Apply through a VA-approved lender at benefits.va.gov/homeloans. Make sure to compare total costs since refinancing restarts your mortgage.

Debt Consolidation Loans

If you have stable income and decent credit, a debt consolidation loan can simplify repayment by combining multiple debts into a single monthly payment, often at a lower interest rate.

This approach can make it easier to stay current, reduce total interest, and avoid the credit damage that can come with debt settlement. Banks, credit unions, and online lenders all offer consolidation options, so compare rates and terms carefully before applying.

While credit score isn’t necessarily a barrier, higher credit scores (such as those above 670), usually help you quality for lower interest rates and better loan terms.

Spotting Scams

There’s no shortage of shady operators pretending to offer help with the best veteran debt assistance programs in 2026. Keep your guard up and verify everything before you sign or share personal information.

- Upfront Fees: If they want money before doing work, walk away.

- Guaranteed Results: No one can promise debt forgiveness.

- Fake Government Links: Always verify you’re on a real .gov site.

- High-Pressure Sales: Real programs let you take your time.

Verification checklist:

- Contact the VA Debt Management Center at 1-800-827-0648.

- Check nonprofit status through the IRS Tax-Exempt Search.

- Verify state licensing and BBB ratings for private firms.

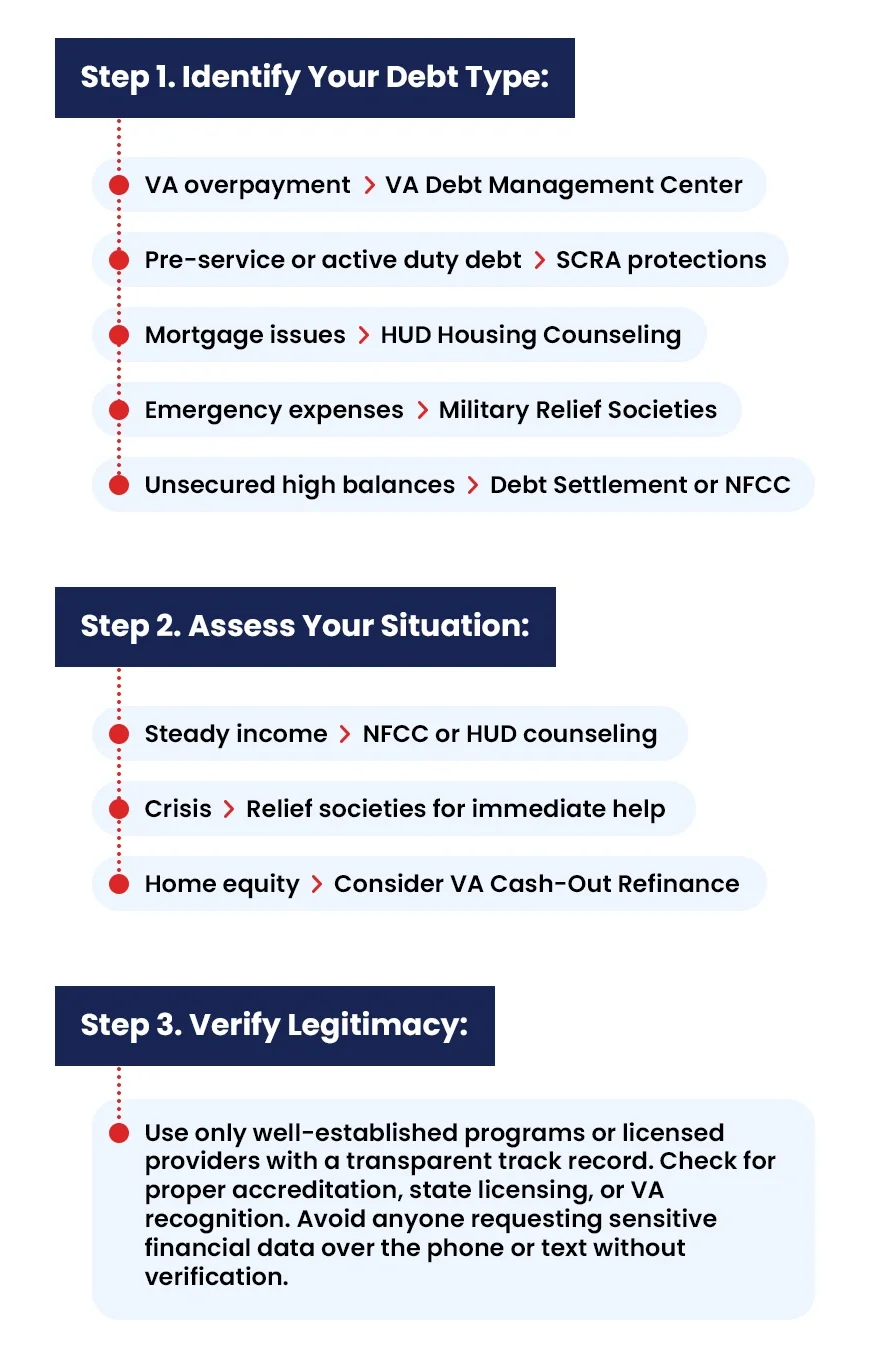

Choosing the Right Program: Your Roadmap

FAQs

|

Question |

Answer |

|---|---|

|

Yes. Most veterans combine programs, but make sure they don’t overlap or conflict with each other. |

|

No. These programs do not affect your disability rating or your monthly VA payments. |

|

If you have had a major drop in income, unexpected expenses, or cannot meet basic bills, you likely qualify. |

|

Yes. Many VA and nonprofit programs extend benefits to spouses and dependents, so it is always worth asking. |

|

Yes. Credit score does not matter much; what matters is showing steady effort and communication |

|

Sometimes. Forgiven debt can be taxed, but VA waivers and nonprofit grants usually are not. |

|

Pay every bill on time, keep balances low, and use a secured card or credit-builder loan to rebuild. |

|

Waiting too long to ask for it. The earlier you reach out, the more options you will have. |

|

Call the program right away. Most will work with you if you are honest about your situation. |

|

Yes, but it is reviewed carefully. They will want to see how you have managed things since the last request. |